U.S. Steel’s senior leadership under Nippon Steel is taking shape — and it looks a lot like it did before the buyout.

The Japanese firm has elected to retain U.S. Steel president and CEO David Burritt as well many of the executives around him, according to filings with the Securities and Exchange Commission.

Among senior leadership, only Chief Financial Officer Jessica Graziano and General Counsel Duane Holloway are departing.

Burritt scored a huge payday earlier this month by cashing out $108 million in stock, SEC filings show, some of which came as part of a $72 million compensation package for closing the deal. As part of the package, he also stands to gain $13 million if he’s terminated within the next two years.

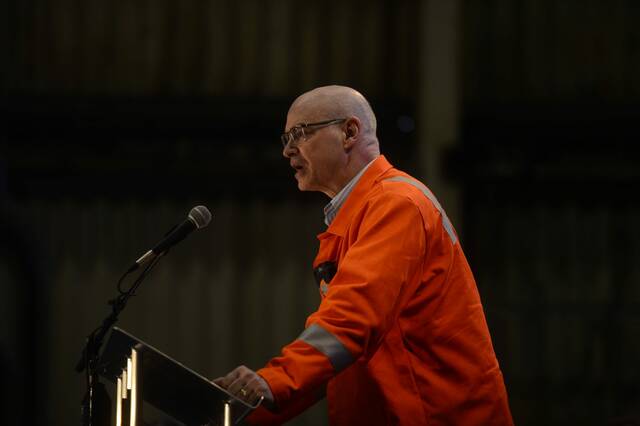

“The hard work isn’t over—and we’re not done,” Burritt said in a prepared statement. “I’m honored to lead U. S. Steel and partner with Nippon to achieve great things. I’m here to help build what comes next.

“A lot of people stepped up to make U. S. Steel great again, including our communities, employees, and the President, and we’re not going to let them down. I am staying because I believe in the incredible work we’re doing together.

“I have the energy and purpose to keep going. I’m excited to move forward with Nippon to create the best future for American steelmaking.”

Josh Spoores, head of Steel Americas Analysis at CRU Group, believes it’s unlikely Burritt, 70, will stay long term.

“I would imagine by the end of the year, there’s going to be a new CEO in charge, but there doesn’t necessarily have to be,” he said. “It’s a big company. There’s a lot of moving parts, and they need some time for transition.”

Several other executives held millions of dollars in stock and have severance agreements.

In a statement, Nippon spokesman Jack Coster praised Burritt for his understanding of the company, track record and commitment to safety.

“This continuity is important as we move quickly to initiate our massive investments to upgrade and revitalize U.S. Steel’s operations and become the best steelmaker with world-leading capabilities,” he added.

Nippon seems more intent on shaking up U.S. Steel’s board of directors.

Burritt was reappointed there, but his only co-directors so far are three Nippon executives. They are vice chairman Takahiro Mori, who became Nippon’s face of the deal in the U.S., executive vice president Naoki Sato and managing executive officer Hiroshi Ono.

U.S. Steel wrote in its filing the remaining regular board seats will be filled “as promptly as practicable.” It’s also waiting on President Donald Trump to select a “Class G” director who, at his direction, can block certain major business decisions. This is a key feature of the national security agreement Nippon signed to earn the president’s blessing for the buyout bid in late May.

The agreement, which was made official last week, also stipulates that U.S. Steel must have an American CEO and a majority American board.

Additional details of the pact came to light this week, once again because of an SEC submission, showing that control over the government’s “golden share” will shift from Trump to the Treasury and Commerce departments after he leaves office. The government’s say over whether U.S. Steel closes, idles or sells plants under certain circumstances also was revealed to expire in June 2035.