Aspinwall voters will choose between seven candidates for four council seats in the November general election.

Democrats Patti McCaffrey, Andrew Corey-O’Connor, Jeff Harris and Lara Voytko will vie against Republicans Donald Mazreku, Terry Nelson Taylor and Aggie Lotz.

All terms are four years.

Here’s a look at the candidates:

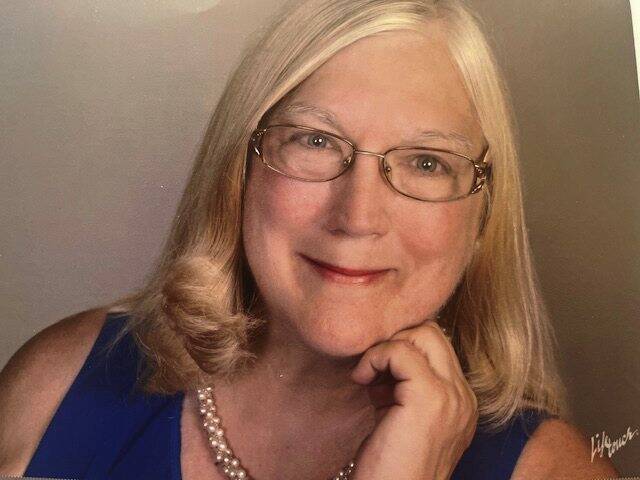

Patti McCaffrey

Age: 62

Democrat

Education: Alan Kells Real Estate School

Occupation: Realtor with RE/MAX Select Realty

Community involvement/volunteer work: Aspinwall Neighbors, community director for The Riverfront Theater Company, member of the Aspinwall Zoning and Hearing Board, Aspinwall Parking and Sustainability Committee member, Former CERT (Certified Emergency Response Team) member, elected female representative for District 3 on the Aspinwall Democratic Committee, Former Aspinwall Council and chair of Planning and Zoning.

Years residing in municipality: 25

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

“It is so very important to maintain good relationships with fellow elected officials, such as State Rep. Mandy Steele, Sen. Lindsey Williams and Congressman Chris Deluzio to work jointly on obtaining funding both on the state and federal levels to help keep our local taxes manageable.

It’s important to have clear and consistent financial data from a historical perspective for proper planning and projecting financial needs in both the short term and long term for the community. My focus has been to bring greater transparency regarding the budget process to the residents. Budget discussions should be ongoing all year, and not just the last few months of each year.

Aspinwall currently is working with a very outdated system, making it harder to understand past spending and costs, resulting in fragmented information for proper planning. With so much technology at our disposal, it’s time to update our budget system to meet the needs of the community and for greater transparency.”

What capital improvements do you feel are warranted, even if they come with a slight tax increase?

“I was happy to serve on the Comprehensive Plan Committee starting in 2019 to assist in getting a road map in place for planning long and short-term capital improvements for Aspinwall. The mainstay of that process was to have as much community involvement and input as possible. The community came out in a big way via many in-person workshops and a community-wide survey to tell us what was most important to them. Some of the items included keeping as many trees as possible, better maintenance of our brick streets and a renewed focus on our parks.

We have already started to implement many of the projects that came out of the Comprehensive Plan and more are to follow. As a council member, knowing what the community wants for these improvements is critical. No one really likes the idea of raising taxes, but when you have the buy-in from the community, it takes the sting out of higher taxes a little.”

Lara Voytko

Age: 56

Democrat

Education: Duke University Class of ‘91. Double major — BA Political Science; BA German

Occupation: Immunohistochemistry Senior Sales Specialist for Leica Biosystems

Community involvement/volunteer work: Current council member, Leader of Priority Aspinwall

Years residing in municipality: 30

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

“All projects and services must be heavily vetted and reviewed for fiscal responsibility, keeping in mind projects are funded by the citizens through taxpayer dollars. Aggressively seeking grant opportunities is one avenue to fund projects. However, creative funding is also essential.

For example, we have engaged stakeholders such as local hospitals and citizen donors to supplement the available infrastructure budget to tackle the worst areas of brick on Delafield Road. This work will start this year and continue into 2026.”

What capital improvements do you feel are warranted, even if they come with a slight tax increase?

“Capital improvements that ensure the safety and well-being of our citizens are essential. One example is shoring up the spalled and crumbling 5th Street retaining wall, a million-dollar project that has been avoided for years. We engaged PennDOT, our senator and representatives, but were unable to obtain grants to help with this essential repair.

“Over several years, we put aside enough money to happily report that the work will start and be largely completed before the end of the year. Still, council must always work in a fiscally responsible manner. It is essential we scrutinize proposed budgets every year to seek opportunities to revise millage rates if possible and keep more of our citizens’ dollars in their own pockets.”

Donald Mazreku

Age: 53

Republican

Education: D.Ed.

Occupation: Director of student services at the Western PA School for the Deaf

Community involvement/volunteer work: Aspinwall Memorial Day Sign Language Interpreter, Scouting America Troop 380 volunteer/merit badge counselor, Aspinwall Chess Club co-founder

Years residing in municipality: 8

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

“I envision a fiscally responsible council that delivers new services and projects without raising taxes. Our council pledge should include a comprehensive budget review to eliminate wasteful spending and reallocate savings to high-priority areas, such as infrastructure, public safety and essential services.

I want to justify all existing programs and make financial data easily accessible to the public for every taxpayer dollar. We should exhaust every alternative funding option, aggressively pursuing state grants and low-interest loans from agencies like the PA DCED, leveraging federal funds and strategically growing our tax base. This approach ensures clear priorities and accountability while maintaining a balanced approach to taxes.”

What capital improvements do you feel are warranted, even if they come with a slight tax increase?

“We must prioritize responsible, long-term investment over simple, short-term fixes. The quality of life in Aspinwall relies on the strength of our community infrastructure, yet our failing roads and outdated utilities currently cost taxpayers a significant amount in costly repairs.

“Our council needs to develop a strategic, multi-year Capital Improvement Plan. Investing in resilient infrastructure is the foundation of a thriving community, as it directly improves public safety, attracts new economic growth, and ensures our town is built to last. Voters have a right to expect a clear plan from their representatives that prioritizes long-term security and efficiency. Through a fiscal priority approach, taxes do not need to increase. More can be done with less.”

Andrew Corey-O’Connor

Age: 45

Democrat

Education: Declined to answer

Occupation: Hospitality management

Community involvement/volunteer work: Declined to answer

Years residing in municipality: 17

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

“Aspinwall is a community that thrives when we work together. By combining smart planning, outside funding and strong partnerships, we can continue to enhance the quality of life here without putting undue strain on taxpayers.”

What capital improvements do you feel are warranted, even if they come with a slight tax increase?

“A modest increase in real estate taxes if and when needed should help the borough to pursue capital projects that deliver long-term benefits, improve safety and enhance quality of life for residents.”

Jeff Harris

Age: 56

Democrat

Education: BA, Virginia Tech

Occupation: Director of customer success

Community involvement/volunteer work: Council president, Shade Tree Commission volunteer.

Years residing in municipality: 18

How would you balance the need for new projects or services with the responsibility to keep taxes manageable?

“As council, we work hard to keep taxes fair while ensuring the services and infrastructure our community relies on remain strong. In 2024, we approved a modest tax increase — historically consistent with past adjustments — even while navigating the pandemic, inflation and other outside pressures.

Of that increase, 0.5 mills were dedicated to emergency services, with additional funds supporting overdue infrastructure like the 5th Street Wall. We’ve also prioritized securing outside grants to offset borough matches, allowing us to move forward with projects such as new pickleball and multi-use basketball courts without additional strain on taxpayers. Equally important, we are committed to maintaining healthy reserves so we can respond to emergencies and unforeseen needs without raising taxes each time. Through careful planning, external funding and fiscal discipline, we can protect core services, invest in critical infrastructure and enhance community amenities while keeping taxes manageable.”

What capital improvements do you feel are warranted, even if they come with a slight tax increase?

“When a project impacts safety or essential services, investment is unavoidable, even if it requires a modest tax increase. Council is addressing long-deferred maintenance such as the 5th Street Wall, while advancing Phase 1 of our Comprehensive Plan with new pickleball and multi-use basketball courts to enhance community recreation.

Looking ahead, replacing the Upper Aspinwall Water Tank is critical to ensuring reliable water service and fire protection. Freeport Road safety also remains a top priority. Now that Route 28 detours are complete and the People’s Gas project is ending, we can refocus efforts there, along with improving access to our municipal works facilities and the entrance to Aspinwall Rivertrail Park, protecting both employees and families. By pursuing grants to offset borough matches, we reduce the tax burden while still delivering results. Careful planning and outside funding allow us to strengthen infrastructure and make quality-of-life improvements that keep Aspinwall resilient.”

Terry Nelson Taylor

Age: 75

Republican

Education: Master’s degree in information science with a minor in communication

Occupation: Fox Chapel High School Forensics/Model UN Coach and Redeemer Lutheran School librarian

Community involvement/volunteer work: Ongoing fundraising for our community programs by conducting Aspinwall History Walking Tours for the past four years

Years residing in municipality: 43

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

“It all begins with detailed budget planning based on both short- and long-term goals. Proper research into other sources of funding, other than relying on state funding, is essential.

Flexibility in timelines for new projects is essential as changes may be needed until funding is available.”

What capital improvements do you feel are warranted, even if they come with a slight tax increase?

“I believe we all need to live within our means. Fiscal responsibility, when properly managed, negates the need for tax increases in most instances, not including emergencies such as weather-related ones, for example.

Involving the community for input is vital, especially when it involves decisions. Make budget cuts to balance the budget rather than raise taxes.”

Aggie Lotz

Age: 65

Republican

Education: Business management major with marketing (minor) from Robert Morris College; Marketing Strategy for Business Leaders Certificate from Cornell SC Johnson College of Business

Occupation: Retired vice president of The ChemQuest Group, Inc.

Community involvement/volunteer work: Aspinwall Presbyterian Church (current deacon, choir singer; former treasurer/bookkeeper); Occasional District 1 poll worker; Bread of Life Food Pantry volunteer

Years residing in municipality: 21

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

“In my management career spanning four decades, I delivered annual balanced budgets for two employers, meeting revenue and expense targets. In my experience, balancing a budget involves reassessing revenue sources and expense line-items along with contract/finance terms and costs, vendor selection criteria and vendor and employee performance every quarter.

I found this to be a successful approach for my previous employers: CMU nonprofit research affiliate, SSPC, for 14 years; and the ChemQuest Group, a global management consultancy in industrial materials. This method also worked well as church treasurer. Using my time-tested, honed method of balancing the borough’s budget, I’d thoroughly assess the value of the proposal to Aspinwall by garnering input from borough employees, knowledgeable constituents/stakeholders, external project/service experts and other municipalities and entities. Once approved, timely implementation of the proposed community offering from a budgetary standpoint would follow.”

What capital improvements do you feel are warranted, even if they come with a slight tax increase?

“I will serve my community primarily as a good steward of current taxpayer revenue without raising tax millage while bringing my decades of experience in high-performing materials, including in municipal works, to my council role. I won’t come into a capital improvement proposal with all the answers, rather collaborating with my council colleagues, borough employees, stakeholders, experts and other municipalities, I’ll do a comprehensive needs assessment, outlining optimal technologies, qualifying labor credentials and the planned time commitment, any viable alternatives and the opportunity cost in terms of postponing other projects due to financial constraints or the borough manager’s oversight.

The timing of implementation will similarly involve multiple criteria, such as evaluating public safety and hazards — before, during and after commencing with construction and installation — factoring in the potential for property and infrastructure damage, financing changes and other predetermined considerations.”