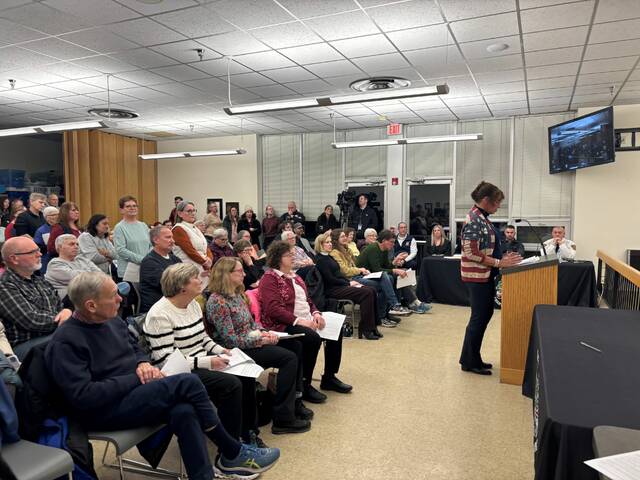

A proposed real estate rate tax increase of 0.3 mills in Franklin Park for 2025 will be voted on at a special meeting at 7 p.m. Dec. 4 at the municipal building on West Ingomar Road.

Borough council will consider the increase with the adoption of the 2025 budget. The current rate is 1.29 mills.

The draft budget for next year has a projected deficit to exceed $1 million. According to the borough, the most recent real estate tax rate increase in Franklin Park was by 0.213 mills in 2016 to finance the debt incurred to build a new fire station.

Uday Palled, council president, said officials have looked for ways to reduce costs and have done so, but there are only so many cuts before services in the borough are affected.

“Nobody likes tax increases,” he acknowledged. “At the same time, you can’t demand the high-level services that the borough provides at a bare-bone costs.”

Public works and public safety are the biggest expenses for the borough.

“We really want to avoid service cuts,” Palled said. “We scaled back as much as possible. We’re paving less. We cannot scale back on public safety.”

There are costs that the borough must fund, such as annual increases in employee compensation and pension obligations. Also, the costs of federally mandated programs and aging infrastructure have continued to climb.

The anticipated annual cost to repair and replace failing stormwater pipes, catch basins and detention facilities will be $500,000 to $800,000 per year, according to a recent study by the borough’s stormwater engineer.

Currently, a property assessed at $100,000 pays $129 per year in real estate taxes to Franklin Park. A property assessed at $200,000 pays $258 annually, and a $300,000 property pays $387.

Under the proposed increase, a property assessed at $300,000 would have an approximate $90 increase in taxes, for a total annual cost of $477, according to information presented at a Nov. 20 meeting.

The proposed increase would generate about $550,000 in annual income for Franklin Park.

Since Allegheny County has not updated the assessed value of real estate since 2012, many Franklin Park property owners have not seen an increase in their local real estate tax. At the same time, most properties in the borough have been significantly appreciated, per the borough discussion.

There was a 2016 increase for the fire company debt to pay for the new station. The debt will be paid off in 2036. The last rate increase to the general fund operations was in 2003.

Franklin Park currently has the fourth lowest real estate tax rate in Allegheny County, according to the borough.

To preserve green space, a top desire by residents when making the 2023 comprehensive plan, Franklin Park has acquired more than 66 acres over the past several years for preservation, but that came at a cost and removed those properties from the tax rolls.

Palled said the land acquisition is done where appropriate, and while the borough may miss out on potential tax revenue, it would also have to finance road and infrastructure maintenance, public safety and other services. So preserving green space can also save the borough money in the long term.

Grants, delaying capital improvement projects and drawing on reserve funds have been some cost-saving measures employed by the borough over the years.

Franklin Park recently received a $45,000 grant from the state to fund a comprehensive recreational plan.

“We’re being judicious. If there are grants or offsets, we will chase them,” Palled said.

He said residents should reference an FAQ page on the Franklin Park website for more information about the budget and costs affecting the borough. Franklin Park also lists the information about the meeting on its social media sites.

Visit www.franklinparkborough.us.