Pittsburgh Mayor Ed Gainey on Friday announced an initiative to protect longtime homeowners in the city from property tax hikes.

The goal, the mayor said, is to ensure that people who own homes in neighborhoods where property values are skyrocketing don’t find themselves struggling to pay their taxes if their property is reassessed.

“Families who have spent decades building their communities deserve to stay and benefit from the value they’ve created,” Councilman R. Daniel Lavelle, D-Hill District, said at a Friday press conference in the city’s Crafton Heights neighborhood.

The city wants to enact a Longtime Owner Occupant Tax Exemption Program, or LOOP. Gov. Josh Shapiro signed the tax exemption into law last year.

Officials said the measure will be introduced to City Council next week. It would not affect property taxes paid to Pittsburgh Public Schools or Allegheny County.

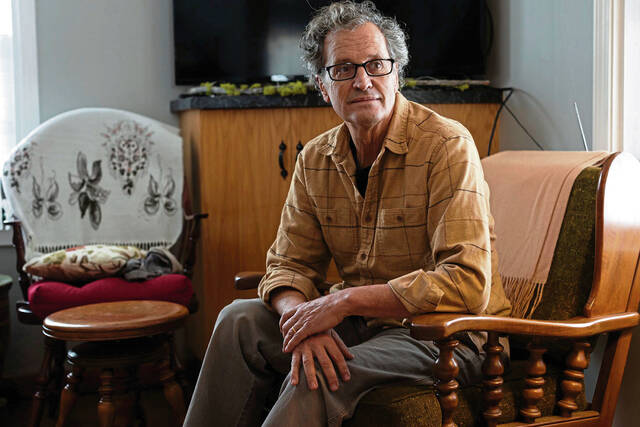

“Citywide, property values have increased nearly 20% from January 2021 to 2025,” said Jake Pawlak, director of the Office of Management and Budget. “These rapid value increases are placing serious cost pressures on existing homeowners.”

Pawlak noted that jumps in property values can be good for people by creating generational wealth for those who can afford to stay in their homes.

But for some — Pawlak listed working families, seniors on fixed incomes and those with lower income who inherited a home from family — rising property values could make taxes so high that staying in a home becomes unaffordable.

Assessment appeals or a countywide property reassessment could trigger such tax hikes.

If Gainey’s tax relief plan is approved, it will cap property tax payments for working-class homeowners who have owned and lived in the same property for at least 10 years.

That requirement is dropped to five years if they received housing assistance, Pawlak said.

Qualifying homeowners also have to be up-to-date or on a payment plan for existing tax bills and make no more than 120% of the area median income.

It will be available for people who saw their assessment values jump by more than 125% in one year or 50% over five years.

Pawlak said he does not believe anyone is qualified for the tax break this year, but said it’s important to have in place for future reassessments.

“It’s about preparing for the future,” he said.

The tax relief would not apply to property owners who don’t live in the homes.

Gainey said the latest initiative is part of a broader effort his administration is undertaking to bolster the city’s supply of affordable housing and protect homeowners.

Officials also highlighted the OwnPGH program, which provides up to $90,000 in financial assistance to low-income homebuyers purchasing houses.

The initiative has so far helped 150 people buy their first homes. More than 90% of them were minority- or women-led households, said Alicia Majors, assistant director of housing support at the Urban Redevelopment Authority.

Friday’s press conference was held outside a house purchased through the program.

Gainey has also recently spotlighted efforts to use the Pittsburgh Land Bank to turn vacant, blighted properties into homeownership opportunities.