Hard work, bond refinancing and covid pandemic-related savings have helped Penn Hills School District cut an estimated $18 million deficit to nearly zero in five years, according to a newly released audit report.

Auditor Mark Turnley said he is “guardedly optimistic” about the district’s financial future.

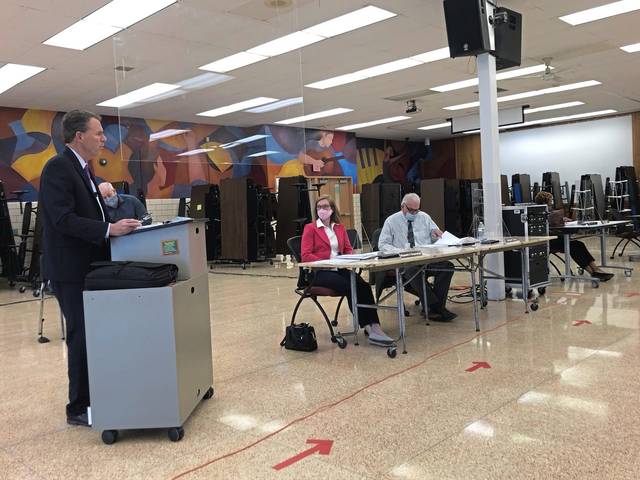

“When you look at the change from that five-year period, it’s really an amazing thing to see where you were at in that point in time as to where you are now,” he told the school board and administrators Tuesday night. “I know you know your work is still cut out for you.”

The district was close to having a negative $19 million fund balance in the 2017-18 school year. This past school year, the deficit was just under $9 million.

“A fund balance is your savings, so to speak, that’s available to fund future operations,” Turnley said. “It’s important to have a good fund balance, and they’re on their way to doing that. What has happened is costs exceeded revenues for a period of years, which put them in the red.”

Pandemic savings

What happened last school year, and into the current one, is the covid pandemic. It forced nationwide school closures and districts to develop virtual learning plans in lieu of in-person instruction.

States continue to ease restrictions as vaccinations increase.

The audit report shows Penn Hills saved more than $5 million in transportation, plant and custodial services and instruction costs the last fiscal year. Coupled with a near $3 million debt services adjustment with refinancing, the district dropped its deficit to a little more than $245,000.

“We had some big things happen in saving some money because of the pandemic,” said Dan Matsook, Penn Hills state-appointed chief financial recovery officer. “A lot of things kind of worked in a positive way, and we were able to take a big bite out of that fund balance deficit. Our goal is to keep it going in that direction when things get back to normal.”

When things do get “back to normal,” there is not expected to be as much transportation and maintenance savings due to students being back in the buildings full time.

Penn Hills has operated largely on the hybrid model this school year with students split into two groups, each group in school a couple days a week and remote learning during their off time.

Other financial moves

The past few years the district has made staffing and program cuts, eventually recalled some of those workers and made numerous educational adjustments to trim expenses.

More than $100 million in bond refinancing in late 2019 knocked off about $12 million in long-term debt and reduced annual payments.

Matsook, which the board attempted to remove as recovery officer, was appointed in February 2019 after years of working with state-appointed financial consultant Michael Lamb under the Department of Education’s financial watch status.

“We’ve had ups and downs,” Matsook said. “We’ve had our moments, but we’re on a highway right now. We’re still respectful that we’re in this thing together. That’s all part of the growth.

“It’s good that we got to where we are. It’s a nice pat on the back, but our work is far from over. Just as we turned this ship in the right direction, the ship can turn the other way.”

Board President Erin Vecchio offered a reluctant thank you Tuesday to Matsook as she commended the rest of the administrative team and her fellow board members.

“It’s teamwork,” Vecchio said. “We’re all working together to make this district go further. Everybody thought it couldn’t be done, but we’re doing it.”

Vecchio said they are looking to save more than $1 million by refinancing another bond by the end of this year.

The audit report was posted in the school board meeting’s online agenda on the district’s website.

The 68-page report also notes the district still has an estimated $169 million debt, which has been reduced over five years from about $172 million. It’s projected to be repaid by 2042.

“The Penn Hills School District continues to face a financial burden above and beyond what most districts are experiencing due to the construction of two mega-sized schools that were completed in 2012 and 2014,” the report states.

District officials continue to work on their 2021-22 budget, which is expected to be passed by the end of June.

“We have just been watching all of our pennies,” district Business Manager Eileen Navish said. “We’ve been very vigilant in making sure that we’re maximizing our revenue and we’re spending properly.”

Turnley said school districts should have a fund balance of about 8% of their budget, which would mean about $7.1 million for Penn Hills.

One of the factors of getting out of financial recovery status is having an estimated $4.5 million fund balance for three consecutive years.

Matsook plans to present an amendment to the district’s recovery plan on April 21.