Pittsburgh Public Schools may be pursuing its first property tax increase in five years.

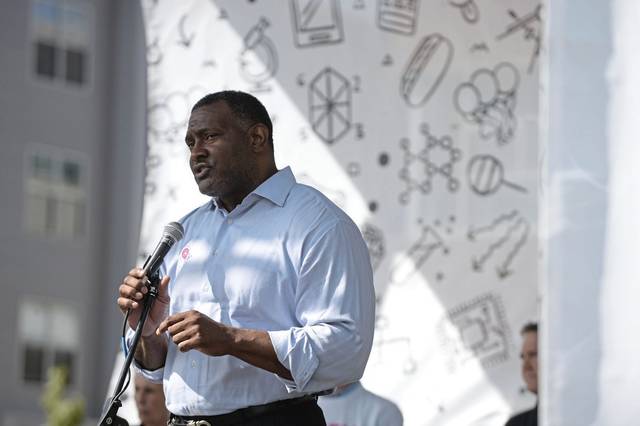

Superintendent Anthony Hamlet is asking the school board to consider a 2.3% increase to the district’s 9.84 mill property tax levy, the district said in a statement. It would be the first tax hike since 2014, when a 2% increase was approved.

The hike would allow the district to maintain 5% of its budget in reserve, a school board mandate, Hamlet said.

The chief financial officer of the district is also recommending putting an end to the practice of diverting part of the wage taxes from the district to the city — something that started nearly 15 years ago when the city was on the verge of bankruptcy.

City residents pay a 3 percent wage tax. Originally, 2 percent went to the schools and 1 percent to the city. To address Pittsburgh’s fiscal distress, a 2005 reform changed the formula to 1.75 percent for the schools and 1.25 percent for the city.

“Now that the city has exited its financial distressed status, it is appropriate that we enter into conversations to address the earned income taxes currently diverted from the school district,” Chief Financial Officer Ronald Joseph said in a statement.

The district’s 2020 budget will be released Nov. 13.

“The city – which will present its own 2020 budget next Tuesday – was not made previously aware of this proposal from the district, but is always open to discussions from interested parties,” said Tim McNulty, spokesman for Pittsburgh Mayor Bill Peduto.

The proposed $665.6 million budget is a 2.4% increase — $15.6 million — from the 2019 spending plan.

It includes a $27.3 million deficit, down $5.1 million from the 2019 deficit of $32.4 million, according to the district.

The deficits have been covered using the district’s reserves, but the school board mandates that the district keep 5% of its budget in reserve. Five percent of $665.6 million is $33.28 million.

Hamlet said debt service costs have decreased and the cost of health care have stabilized. However, employee salaries, pension costs and charter school payments keep increasing, necessitating consideration of a tax hike, he said.

Talking with city officials about ending the wage tax diversion is a “thoughtful alternative to increasing the burden for taxpayers,” Hamlet said in a statement.

Returning that money to the district could allow it to keep 5% in reserve through 2023 without a property tax increase, Joseph said.

Unless the school’s wage taxes are restored, by 2021 the district won’t have 5% in reserve, even if the millage rate is increased to the highest amount allowed by state law, Joseph said.

After the preliminary budget is released next week, the final budget will be proposed on Nov. 26. A public hearing on the budget will be held Dec. 2 and the spending plan will be up for a vote on Dec. 18, according to a timeline released by the district.