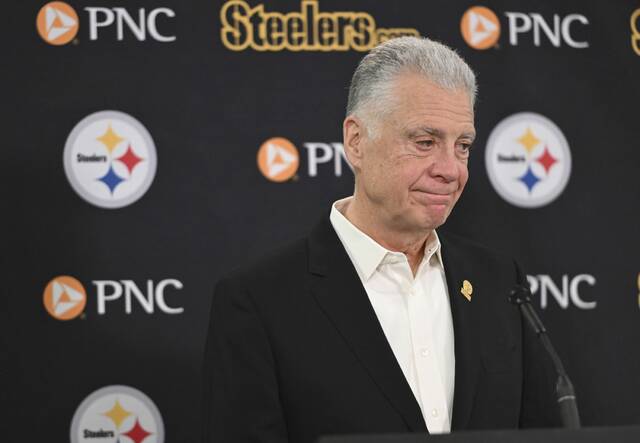

Pittsburgh City Controller Michael Lamb said Friday in his annual comprehensive financial report that the city is in a “very healthy” fiscal position as it continues to rebound from the covid-19 pandemic.

The report shows that the city ended last year with a surplus, thanks in large part to the infusion of American Rescue Plan funding.

“We’re doing well given the circumstances,” Lamb said.

The city’s general fund brought in $24.5 million more than it spent last year, according to the report. The general fund totaled $606 million in 2021, an increase of about $67.7 million — or 12.6% — from 2020.

Without the $335 million in American Rescue Plan funding it received, Lamb said the city would’ve ended last year with a $9 million deficit. Instead, the city transferred $33.8 million of the funding into its general fund, and most of the cash was used to avoid imposing layoffs and to fill vacant positions.

The city’s fund balance, or reserve fund, totals $106.8 million. That represents 19.6% of 2021 expenditures, a positive sign considering that 10% is generally considered a healthy balance to carry into a new fiscal year, according to the Controller’s Office.

“We’re in a very solid position,” Lamb said.

The city’s largest source of revenue is the real estate tax, which generates 30.7% of the city’s tax revenue. That’s followed by earned income tax, which makes up about 22.9% of tax revenue, Lamb said.

Earned income tax was up from pre-pandemic levels in 2021, with the city bringing in about $114 million in earned income tax compared with $108 million in 2020, Lamb said.

A “very vibrant” real estate market also spurred a jump in deed transfer taxes, Lamb said. Deed transfer tax revenue totaled $64 million last year, up from about $44 million in 2020 and $37 million in 2019.

Other taxes are lagging behind pre-pandemic levels.

Parking tax revenue totaled $36.7 million last year, up from $31.3 million in 2020 but still far below the $60.6 million generated in 2019 before covid-19 struck, resulting in an increase in remote work.

Likewise, the amusement tax generated about $7.5 million last year, up about $5 million from 2020 but below the $16.1 million generated in 2019.

Among venues, PPG Paints Arena generated just $573,614 in non-hockey amusement taxes last year, down from more than $5.6 million in 2019. Heinz Field, on the other hand, generated more than $4.2 million last year, surpassing the $151,000 generated in 2020 and the $3.8 million generated before the pandemic in 2019.

American Rescue Plan funding is scheduled to end in 2024.

“That’s going to be the challenge, how we fill that gap,” Lamb said, referring specifically to the parking tax. “I don’t believe that we’ll be back to $60 million a year in parking taxes by the time we come to the end of ARPA in 2024.”

Lamb pushed Mayor Ed Gainey to negotiate with the city’s nonprofits for a payment-in-lieu-of-taxes, or PILOT, program. Under that system, the city’s nonprofits — including universities and health systems — would pay a portion of what they would pay in taxes if they weren’t designated as nonprofits.

That measure has been introduced in City Council. Major nonprofits in the city have largely declined to comment on whether they would participate.

Another key to growing to the city’s revenues, Lamb said, may be growing its borders. The city hasn’t expanded beyond its 55.37 square miles in nearly 100 years, he said. Lamb has been supportive of a controversial movement to annex neighboring Wilkinsburg. City Council voted down the original proposal to annex Wilkinsburg, but almost immediately launched their own investigation into the matter.

Lamb is opposed to a recent report that suggested taxing unearned income, including income from dividends, capital gains, patents, royalties and trusts. Lamb said he suspected it’s not legal and would hurt senior citizens and others who rely on unearned income.

“It’s not just fat cats with dividends,” Lamb said. “It’s low-income people who may have a small pension.”

In his annual comprehensive financial report, Lamb also touted the city’s pension fund of nearly $700 million, up from $595.5 million the year before.

“That’s more money than we’ve ever had” in the pension fund, he said. “That is probably the best success financially in the city we could point to over the last 10 years.”

As for spending, public safety was the city’s largest expense, accounting for just over 49% of the city’s spending. Government operations accounted for another 22% of the city’s spending, while maintaining the city’s highways and streets accounted for about 19%.