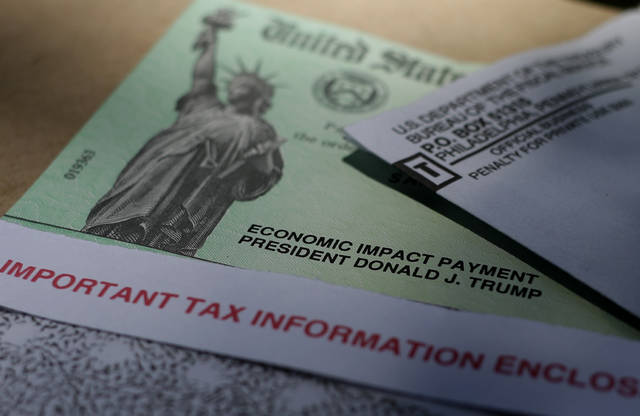

The $600 stimulus checks approved by Congress and President Trump last month were meant to provide much-needed economic relief to Americans battered by the coronavirus pandemic. Most already have received their money, but technical glitches and administrative challenges left millions wondering when theirs would arrive. Here’s what you need to know about the status of the second round of economic impact payments:

1. Why hasn’t everyone received their payment?

Most eligible Americans have received their money via direct deposit to their bank accounts, according to the IRS. For millions of others, however, the process went awry.

Commercial tax preparers like TurboTax, H&R Block and Jackson Hewitt often use temporary bank accounts to manage customers’ refunds. The IRS accidentally sent many payments to these defunct bank accounts. The National Consumer Law Center estimates that up to 20 million Americans may have been impacted by the administrative issue.

Tax preparers are working with the IRS to fix the problem.

Some people will receive payments in the mail, either as a check or prepaid debit card.

Most people affected by the error should already have their money, or expect to receive it soon.

2. How can I check the status of my payment?

Go to irs.gov/coronavirus/get-my-payment. Users can enter their Social Security number, date of birth and address to see when how and when their stimulus payment was issued.

If the site shows the money was deposited in a bank account you don’t recognize, it’s likely because of the issue with tax preparer’s temporary accounts. It will be rectified.

3. Why did I get less money than I was expecting?

Base payment is $600 for individuals or $1,200 for couples, plus another $600 for each dependant child in the household. That’s half the amount included in the first round of stimulus checks issued in April.

The amount of money issued is based on the adjusted gross income reported in recipients’ 2019 tax returns.

Individuals making more than $75,000 a year, couples making more than $150,000 combined, or individuals filing as the head of a household making more than $112,500 will receive less, with the amount adjusted based on their income.

The reduced amount reaches zero at incomes of $87,00 for individuals, $174,000 for joint filers, and $124,500 for heads of households.

4. What should I do if my payment never arrives?

While the IRS is working to ensure everyone gets their money, some people inevitability will fall through the cracks.

Those who never receive their payments, or receive less than they were expecting, can claim the Recovery Rebate Credit on their 2020 federal tax return, according to the IRS. If they are eligible, they will receive the money in their tax refund.

5. Will this be the last stimulus check of the pandemic?

It’s too soon to say, but it seems likely a third round of stimulus checks could be coming.

President-elect Joe Biden has called for $2,000 stimulus checks, a move supported by incoming Senate Majority Leader Chuck Schumer, the Washington Post reported. It’s unclear whether Congress will approve such a plan, but some Republican lawmakers, including Florida Sen. Marco Rubio, approve of the idea, according to Fox Business.

One unanswered question is whether payments in a third round would be $1,400 or $2,000. While $2,000 is the target agreed on by many lawmakers, its unclear whether January’s $600 payments are considered part of the total.