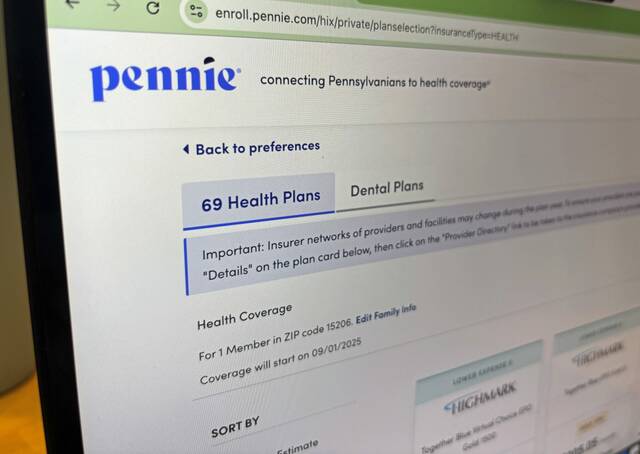

Indiana County resident Tony Gonzales and his wife are just two of the almost half a million Pennsylvanians who could be hit with sharp health insurance price hikes next year.

The college professor said he and his wife enrolled in Pennie, Pennsylvania’s Affordable Care Act (ACA) health insurance exchange, about two years ago, before he was diagnosed with cancer.

He and his wife are able to meet an out-of-pocket maximum of $7,500. Completing treatments including chemotherapy and radiation, Gonzales said he quickly meets that amount.

Now, with federal officials threatening to end subsidies that help keep Pennie premiums low, Gonzales said he could be paying an additional $200 per month for insurance.

Gonzales is one of 450,000 enrollees that stand to see higher premiums as the fate of the enhanced premium tax credit, a Biden-era expansion of existing subsidies for the ACA, is called into question.

“The Enhanced Premium Tax Credits through Pennie are critical for me and my wife to afford our health coverage,” Gonzales said.

If the federal government fails to take action, the enhanced credit will expire Dec. 31.

“We can’t afford our premiums to go up and meet our everyday expenses,” he said. “If costs go up we might need to switch to a higher deductible plan that doesn’t cover our needs or drop my coverage altogether, which would be detrimental to my cancer treatment.”

Pennie, insurers and health care access advocates are aware time is running out for a decision regarding the extension of the enhanced credit and have put out a call to action to lawmakers to vote for the extension.

Call to action

Devon Trolley, Pennie’s executive director, said the price increase is bound to drive away users. She said the upcoming federal funding bill, due at the end of September, is a realistic shot of preserving the more robust subsidy.

She said Tuesday, Sept. 30, is the deadline to ensure no one has to drop their coverage.

Pennie’s open enrollment begins Nov. 1. Trolley said enrollees shopping for plans in October will be able to see what their new costs will be and may be forced to drop to a plan with less coverage or walk away altogether after seeing the price increase.

She said Pennie enrollees often are lower-income but make too much money for Medicaid or retirees waiting to turn 65 and get onto Medicare.

To obtain subsidies, consumers have to submit proof of income to their state’s health insurance exchange.

The exchanges are available only to people who are in the country lawfully and whose other insurance options are considered unaffordable or inadequate. Medicare and Medicaid recipients are not eligible.

Without the enhanced credits, monthly premiums could rise by 300%, state officials say. The average enrollee would have to shoulder a possible 82% increase.

If Congress were to approve the enhanced credit after Nov. 1, there would be disruptions in coverage, but Pennie would update the tax credits so people have the opportunity to have lower coverage costs, Trolley said.

“It would be harder to communicate those cost changes after the (open enrollment) deadline because people may have already chosen to drop,” Trolley said.

Pennsylvania Lt. Gov. Austin Davis said he hears almost daily from residents concerned about rising health care costs and meeting their basic needs such as food costs and bill payments.

“One of my guiding principles is that those who are closest to the pain should be closest to the power. What we’re seeing in Washington is what happens when those who are furthest from the pain have all the power. Billionaires are demanding more and more, and working people are getting screwed,” Davis said. “We need leaders in Washington to listen to the people who are struggling to get by, the people who will see their premiums skyrocket, and we need Congress to take action now.”

The state already has to contend with upcoming cuts to Medicaid funding.

According to Pennsylvania Health Access Network officials, the failure to reauthorize tax credits, combined with slashed funding for Medicaid in H.R. 1, could cause an estimated 245,000 Pennsylvanians to lose their Pennie health coverage.

“Trump and Republicans slashed Medicaid in their One Big Beautiful Bill and refused to extend ACA tax credits. Thousands of people in my district rely on these tax credits to keep their insurance affordable,” U.S. Rep. Summer Lee, D-Swissvale, said in a statement to TribLive. “And now, because Republicans are once again refusing to extend these tax credits, families and seniors could see their premiums go up by thousands of dollars per month. ”

The offices of U.S. Sen. John Fetterman, U.S. Sen. Dave McCormick, U.S. Rep. Mike Kelly and U.S. Rep. Guy Reschenthaler did not respond to requests for comment.

U.S. Rep. Chris Deluzio was scheduled to hold an event today to discuss the dilemma and call for an extension of the credits.

Possible consequences

In addition to rising individual costs, Pennsylvania Insurance Commissioner Michael Humphreys warned the expiration of the enhanced credits could cause a ripple effect throughout the health care sector.

“When coverage becomes unaffordable, people will look to ration their own care,” he said.

This could include taking less of their medications to ration them or waiting as long as possible to see a doctor, causing their conditions to be more severe by the time they see a medical professional.

Michael Berman of Protect Our Care Pennsylvania said this type of care would cause a huge pressure on rural hospitals already “barely surviving.”

Pennsylvanians expected to leave ACA due to lack of enhanced credits will likely be ones needing less consistent health care. This will leave beneficiaries being mainly older and less healthy, causing insurance rates to rise.

Insurers selling coverage on Pennie have proposed an average premium increase of 19% for customers who buy their own insurance and 13% for small businesses regardless of the fate of the enhanced tax credits.