Eight candidates are vying for four seats on the nine-member Pine-Richland School Board in the Nov. 4 election, the results of which could change control of the often divided board.

One seat is up in Region 1 and currently held by Lisa Hillman, who did not seek reelection.

Two seats are up in Region 2, where incumbent board member Christina Brussalis is seeking reelection. Board member Amy Terchick lost her bid for reelection in the primary.

One seat is up in Region 3 and currently held by John Joseph Cassidy, who lost his reelection bid at the primary.

Across the district’s three voting regions, the ballot candidates are split between two political action committees.

Candidates with “Common Sense for PR” include Eddie Boczar in Region 1, Brussalis and Robert Stein in Region 2, and Christopher David Griffin in Region 3.

The group bills itself as representing conservative candidates who will fight for academic excellence, parent involvement and to protect taxpayer dollars.

Stein, a registered Democrat, received a Republican nomination in the primary. Boczar filed as an independent under “Conservatives for Taxpayers.”

Supported by “Together for PR” are Liz DeLosa in Region 1, Amy Cafardi and Melissa Vecchi in Region 2, and Randy Augustine in Region 3.

“We are a collaborative group committed to bringing the best back to Pine-Richland students, educators and the community by focusing on safety, transparency and support,” Vecchi said.

DeLosa was unopposed in the primary and won both the Democratic and Republican nominations. Augustine, a registered Republican, received a Democratic nomination.

Here’s a look at the candidates:

REGION 1

Eddie Boczar

Age: 23

Residence: Pine

Party: Independent conservative

Education: Graduate of Pine-Richland, BSBA in finance from Youngstown State University

Occupation: Account manager at Am-Gard Inc.

Community involvement/volunteer work: Board member of Northern Tier Regional Library; volunteer at St. Aidan Parish

Years residing in the district: 21

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

I believe in a disciplined approach to balance expenditures. The district should prioritize necessary capital projects while carefully reviewing other projects to see the impact on taxpayers. School board members should work together to pursue opportunities to fund projects like grants and fundraising. By working closely with our local representatives, such as Rep. Jeremy Shaffer who resides in the Pine-Richland School District, and Sen. Lindsey Williams, we can secure funding that reduces reliance on tax dollars.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

The population in Pine and Richland has leveled off, student enrollment is stable, and the reliance on taxpayers is growing. A detailed budget analysis needs to be conducted to determine if there are savings opportunities. We should be mindful that any tax increase would place an additional burden on property owners, especially seniors and families with limited budgets, who are dealing with a 36% county property tax hike this year and the threat of another increase on the horizon. My goal is a balanced budget, educational excellence, safe schools and preparing students for success beyond the classroom.

Liz DeLosa

Age: 43

Municipality of residence: Pine

Party: Democrat

Education: 2004 BA in English writing, University of Pittsburgh; 2010 Juris Doctorate: Duquesne University School of Law

Occupation: Attorney and deputy legal director for the Pennsylvania Innocence Project; teach as an adjunct professor at the University of Pittsburgh and Duquesne University School of Law

Community involvement/volunteer work: I care deeply about giving back to my community through both legal advocacy and educational leadership. Each year, I devote many pro bono hours to representing elderly individuals and women in domestic abuse situations, making sure they have the legal protection and support they need.

Alongside my teaching work at local law schools, I travel across the commonwealth to provide training for lawyers, helping strengthen legal skills and access to justice. I also serve on the board of directors for the Allegheny Lawyers Initiative for Justice, supporting efforts to expand legal services in our region. Outside the legal field, I stay involved in local education by chairing the after-school programs for Wexford Elementary’s PTO, where I help provide engaging after school opportunities that inspire learning and growth for Wexford Elementary students.

Years residing in district/municipality: Six

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

That’s a great question and, honestly, it’s something every district is trying to figure out. And with Pine-Richland’s current projected deficit, it’s something we as a community really need to pay close attention to. With state funding often limited, I think the key is to be smart and really focus on what will make the biggest difference for students. We can’t do everything at once, so it’s about setting clear priorities.

Right now, there are several construction projects within the district that simply need to happen. Our administration has done a great job of extending the life of our buildings and facilities for as long as possible, but at a certain point, maintenance and upgrades are necessary. Normally, I’d say we should look first at whether smaller updates or repurposing existing spaces could meet our needs before taking on large construction projects. In this case, I know those options have already been carefully considered. These aren’t “nice-to-haves” — they’re projects that are essential for the health and safety of our students and staff.

Just as important, though, is being open and transparent with the community. We need to have real conversations with families to understand their priorities and make sure they’re part of the decision-making process. At the end of the day, the community has to understand and be on board with supporting longer-term projects. Building that trust and buy-in is just as critical as the financial planning itself.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

I think it’s important to approach any potential tax increase thoughtfully and transparently. Pine-Richland currently has one of the lowest millage rates in Allegheny County — eight lowest out of 43 districts — which has helped keep taxes manageable for families. At the same time, the district is facing a projected $4.9 million deficit for the 2026-27 school year, and both the superintendent and business manager — our financial experts — have said a modest property tax increase will likely be necessary to help close that gap. I think we should listen to their expertise and hear them out.

Our district does a good job of running a very fiscally responsible operation. That said, we also need to make sure we have the resources necessary to fill critical teacher and staff positions, maintain equipment and facilities, and provide the programming and student support that not only help kids learn, but create an environment where learning truly thrives.

I believe a measured, modest tax increase, paired with responsible financial planning, can be part of the solution. But a tax increase alone shouldn’t be the only answer. We should also look closely at both revenue and expenditures — making sure spending aligns with our educational priorities, finding efficiencies where possible, and seeking additional funding sources like grants, partnerships and state advocacy.

The ultimate goal is to maintain the high-quality programs and manageable class sizes that families value, while being transparent with the community about why any increase is needed and how those funds will be used.

REGION 2

Christina Brussalis

Age: 50

Municipality of residence: Richland

Political party affiliation: Republican

Education: B.A., political science, Baldwin Wallace University

Occupation: Homemaker, former consultant

Community involvement/volunteer work: Pine-Richland school director since 2021; was a Girl Scout Western Pennsylvania volunteer and board member and chaired the Pittsburgh Youth Chorus board

Years residing in district/municipality: 10

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

First things first, we need to focus on student achievement and safety. This is where the emphasis of our tax dollars must be. Any new projects or services, regardless of cost, must be weighed against the student and public interest. I am a mom of four and still have three young children in the district. I have a vested interest in giving them and all of P-R’s students the best education possible and to keep them safe.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

The projected $4.9 million deficit represents approximately 4.4% of the operational budget. There are many levers that can be pulled to help erase or minimize the deficit. While understanding where cost is situated within a multimillion-dollar operating budget, there may be opportunities to reduce some cost where it makes sense, without jeopardizing academic excellence. To my knowledge, the district has never undergone a serious analysis of its spending. Passing incremental budgets each year does not push the district to challenge its spending habits and priorities. Implementing disciplined procurement policies and practices alone can lead to significant expense reductions. All options must be investigated and proved out before ever pulling the lever to raise property taxes.

Amy Cafardi

Age: 49

Municipality of residence: Pine

Party: Democrat

Education: University of Pittsburgh, B.A., administration of justice; Duquesne University School of Law, J.D.

Occupation: Attorney

Community involvement/volunteer work: Over the past 20 years, I have been involved in numerous volunteer opportunities, including as a volunteer at both of my kids’ schools, as well as at the youth and school level for Pine-Richland baseball, football, and hockey. I now actively support the Pine-Richland band and dance team.

Years residing in district/municipality: 24

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

My goal is to see that Pine-Richland maintains the level of excellence in academics, services, support and facilities that it has for more than the past 20 years. This is the expectation within our community and among those who choose Pine-Richland as their new home. Creative solutions must be leveraged in order to achieve this goal and maintain fiscal responsibility. This is what our current board should have been focused on for the past four years, instead of political sideshows that have embarrassed our community and left them little time to deal with issues that their delay has only made worse. By working collaboratively with the administration, financial experts and the community, I would focus on what matters and work to find a balance between wants vs. needs while striving to make future focused financial decisions to maintain a position of financial stability for the district.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

A $4.9 million deficit cannot be closed by attrition of existing positions and cuts alone. Unfortunately, our current board majority’s refusal to address the budget has put us in a position where we are forced to be reactive instead of proactive. Although this deficit has been caused by the Allegheny County Common Level Ratio, it has been exacerbated by our current board’s failure to see the financial cliff they were driving us towards until it was too late. We must deal with this issue aggressively in order to maintain the level of services and facilities that our community expects. Without the information available to the current board, it is difficult to identify viable options, however, I would want to explore things such as debt refinancing and approaching community partners like AHN and St. Barnabas to pay their fair share.

Robert Stein

Age: 43

Municipality of residence: Richland

Party: Democrat, but listed on ballot as Republican

Education: BS, operations & information systems management, Penn State; MBA, Pitt; executive MBA, Harvard Business School

Occupation: Associate vice chancellor, Innovation & Entrepreneurship, University of Pittsburgh

Community involvement/volunteer work: Santa’s workshop, Eden Hall; cafeteria worker, Eden Hall and Hance; Kids of Steel, Eden Hall; Junior Achievement class — entrepreneurship, Hance; homeroom parent, Eden Hall; classroom supply donations, Eden Hall and Hance; field rip chapparone, Eden Hall; volunteer board, Children’s Museum of Pittsburgh

Years residing in district/municipality: 22

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

You have to balance the need with the funding available. New projects and services will need prioritized to see what can be funded in future budgets.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

I’d need to do a thorough review of costs/revenue to determine what can be funded under the existing budgets and what, if any, additional taxes would need to be raised to maintain our current service levels. I am not completely opposed to raising taxes, as along as all other options were considered and as a board we determined the tax increase is necessary.

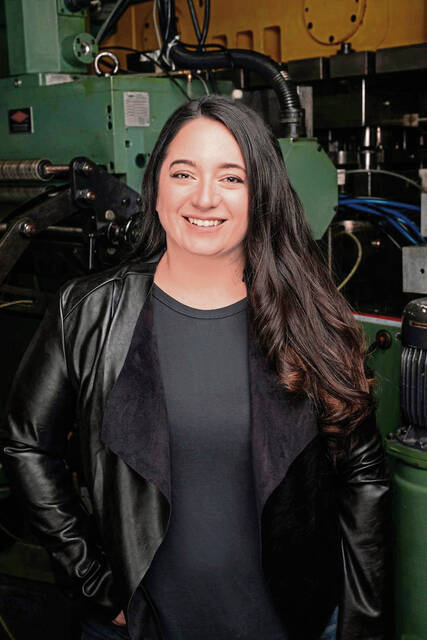

Melissa Vecchi

Age: 43

Municipality of residence: Pine

Party: Democrat

Education: Master of science in organizational leadership (in progress), Johns Hopkins University; Bachelor of arts in communication, Point Park University

Occupation: Vice president, JV Manufacturing

Community involvement/volunteer work: Active board member, Catalyst Connection; sponsor and mentor for student apprenticeship and robotics programs across multiple local schools; volunteer and supporter of Pine-Richland athletics, BotsIQ, and community events; advocate for STEM education and workforce readiness in Western Pennsylvania, and cash scholar award provider for two technical schools.

Years residing in district/municipality: 12-plus

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

As a business leader, I understand the importance of prioritization, accountability, and efficiency. When funding is limited, I believe the district must apply the same principles — prioritize essential student outcomes first, academic excellence, safety, and core services; examine operational efficiency, streamline processes, reduce redundancy, and ensure taxpayer dollars are delivering maximum impact in classrooms; leverage partnerships and grants, working with local businesses, higher education, and community organizations can expand opportunities; transparent decision-making, engage parents and residents in open dialogue so that investments reflect shared community values. Balancing new projects with fiscal responsibility requires discipline: not every idea can be funded, but every dollar must serve our students.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

I take seriously the concerns of both taxpayers and educators. A projected deficit of $4.9 million is a concern for our community and schools. As a candidate, it would not be responsible for me to give a definitive answer on raising property taxes when I have not had the same time, resources, and access to information that the current board has. They themselves have not addressed or answered this growing concern for our community members to date.

What I can commit to is continuing to spend my time learning, reviewing and understanding the challenges our district, and others across Allegheny County are facing. I can pledge to be prepared and make time to collaborate with the administrators and community. I recognize that because of strong past leadership, Pine-Richland has not seen a tax increase in 12 years. If elected, I will listen to subject matter experts, engage openly with the community and make decisions based not on what is best for me personally, but on what best serves our families, students and educators as a whole.

REGION 3

Randy Augustine

Age: 53

Municipality of residence: Richland

Party: Registered Republican, received Democratic nomination

Education: Bachelor’s degree in computer science and mathematics, University of Pittsburgh

Occupation: Software engineer

Community involvement/volunteer work: Volunteered with youth soccer as an assistant coach, assisted with my son’s FLL Lego Robotics team and volunteered time with PR Marching Band activities

Years residing in district/municipality: 17

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

Without knowing the specifics of proposed new projects or services, it’s difficult to offer detailed responses. However, funding decisions must always be guided by clear priorities. If sufficient resources are available, we can proceed confidently. If funding falls short and the initiatives are deemed essential, we would need to explore all available options to secure the necessary support.

Maintaining our district’s commitment to excellence while being mindful of the community’s tax burden requires careful balance. It’s also important to recognize that all homeowners benefit from a strong, high-performing school district. Studies consistently show that homes in top-rated districts are valued 10% to 30% higher than similar homes in lower-performing areas. While tax increases are never easy, even modest ones can be seen as an investment in both our schools and the long-term value of our homes — often a family’s largest asset.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

Every option must be on the table. The current school board majority chose not to take action to address this year’s budget shortfall, and next year’s projected deficit is even larger — expected to grow in the years ahead. Even if we were to raise the tax rate to the maximum allowed next year, a significant shortfall would still remain. As a result, we must consider all possible avenues to increase revenue and reduce expenses.

Can we continue to improve efficiency in service delivery without compromising outcomes? Are there untapped opportunities to generate additional revenue? These are critical questions that require a broader, collaborative discussion — one that includes school leadership, community members, and local businesses.

Christopher David Griffin

Age: 46

Municipality of residence: Richland

Party: Republican

Education: Ordained minister with the Assemblies of God; bachelor’s degree in organizational leadership and development from Geneva College

Occupation: Business development director at Chaney & Associates

Community involvement/volunteer work: Allison Park Church, Pine-Richland volunteer (baseball, football, field hockey, basketball)

Years residing in district/municipality: 13

With state funding often limited, how would you balance the need for new projects or services with the responsibility to keep taxes manageable?

I want the very best for Pine-Richland. I have four children in the school district. Under the conservative majority over the past four years, P-R has climbed to No. 2 in the Pittsburgh region. We definitely have a need for new projects and services. I want top-notch schools and quality education, but raising property taxes is not the first answer. Our taxpayers are already stretched thin thanks to the recent Allegheny County tax increase, so we need to start by ensuring the current budget is used wisely. Let’s cut any and all administrative waste and prioritize getting dollars into the classroom. We should also explore innovative solutions without adding to the tax burden. We must scrutinize spending to keep taxes low and still meet our goals.

The district’s superintendent and business manager are saying a property tax increase will be necessary for the 2026-27 school year to partially address a projected $4.9 million deficit. What is your position on increasing property taxes, and what else do you believe should be done in addressing the district’s revenue and expenditures?

I believe raising property taxes should be the last option in addressing this deficit. Higher taxes makes living in the community more expensive, especially for seniors, low-income families and small-business owners. We have a number of P-R residents that fall into those categories. We need to continue to call for even better management of existing school funds before asking for more. Let’s continue to review district spending to identify waste, inefficiencies or bloated administrative costs. The role of the school board is to keep the administration accountable in its spending. The board is an elected body that acts as the governing authority for the school district to give oversight of the budget and to monitor financial performance. I’m committed to providing top-notch educational outcomes, great sports and strong academic clubs while fighting to keep taxes as low as possible. I believe that we can address the fiscal challenges we face without over-burdening taxpayers.