Blawnox officials are considering implementing a business tax that would charge $400 to those providing goods or services in the borough.

The potential new revenue stream for the small Allegheny County municipality was proposed at a council meeting on Sept. 10.

Borough officials hope to have a draft ordinance ready for advertisement in October and pass it in November.

Business tax revenue estimates would be allocated in December as part of the 2026 budget.

Councilman Matt Stanczak said the goal is to recoup costs for essential services like police, public works, fire and EMS.

The finance committee looked into business taxes in neighboring communities, particularly Aspinwall, which charges businesses $500 per year.

“We felt like we could get away with a lower number,” Stanczak said. “We agreed that $400 feels about right. We’ll look at it and what revenue it brings in next year against what our expenses are and then we’ll keep updating council. What we’re trying to do is level a small fee for businesses in our borough to pay for the services that are provided to them and everyone.”

Stanczak believes the proposed tax will not be a deterrent for new businesses.

Borough Manager Kathy Ulanowicz said a preliminary review indicated there are 125 taxable borough businesses. She plans to confirm that number with Keystone Collections, which would be handling the new tax should it be approved.

The business tax would generate about $50,000 in borough revenue using those preliminary figures.

“There are certain criteria that are exempt,” Ulanowicz said. “Keystone knows what those are, so they’ll be able to send the invoices to who they need to and then let us know which people do or don’t have to pay the tax.”

Councilman Mark Lombardi, who co-owns the Aspinwall pizza shop Casa Del Sole, said he has mixed feelings about the proposed tax.

Lombardi said it may not be a problem for thriving businesses, but it could be a burden for those struggling to make a good profit.

“It’s a concern,” he said.

Councilwoman Elaine Palmer, who has owned and operated Eclips Hair Studio in Blawnox for 30 years, said she supports the business tax.

“If it’s necessary, of course, I respect that decision,” Palmer said. “I respect that a tax may be collected toward essential service fees. Other communities are doing it.”

Borough Solicitor Sam Dalfonso said Palmer does not need to recuse herself from the potential tax vote based on being a borough business owner.

“She doesn’t have a unique interest in it,” Dalfonso said.

Aspinwall hiked its business privilege tax from $100 to $500 in August 2023.

Heth Turnquist, councilman and finance chair, said at the time the tax increase was necessary to help cover rising costs such as infrastructure upgrades, employee salaries and benefits and other general expenses.

The tax generates about $75,000 in potential revenue per fiscal year, Borough Manager Melissa O’Malley on Sept. 10.

Keystone handles Aspinwall billing/tax collection on a July 1-June 30 cycle. Aspinwall has 150 taxable businesses.

The borough’s annual budget runs from January through December, meaning the business tax collection overlaps into two budget years. Payments are received monthly.

O’Maley said Aspinwall’s collected $20,636 in business taxes year-to-date as of Sept. 10.

Business reactions

Reactions from several Blawox business owners were mixed the day after the business tax proposal was announced.

Old Thunder Brewing Company is nearing its fifth anniversary at the former post office along Freeport Road.

It made the official beer of the borough centennial celebration called Positively Blawnox.

Co-owner Josh Taylor said he believes council has the community’s best interest at heart, and $400 a year will not be a detriment for the business.

“If the borough feels like it’s necessary for something like this to potentially go into effect, they wouldn’t do anything that would be harmful or detrimental to the community or the businesses of Blawnox,” Taylor said on Sept. 11. “They would only want to help enhance the current and future landscape for business opportunities of the borough. This is the first I’m hearing of it. To really understand it, I would have to let it marinate and digest it a little bit better. … My initial gut reaction is financially, that’s fine. If it’s $400 a month, that’s a different story.”

Ronny “Moondog” Esser has two businesses, both along Freeport Road. He opened the bar/lounge Moondogs in June 1988 and Starlite Lounge in September 1994.

He said the proposed tax should not be a problem for most businesses in town, and wants the borough to use the funds to help promote the community and its shops.

“Are we going to get anything out of it?” Esser asked. “If there’s something constructive that can come of it, then great. If it’s just a tax to tax (then no). Look down the street. Half of the buildings are for rent or for sale. Small towns need to have incentives, not things to push people away.”

He lamented that it is never a good time to raise taxes.

Esser suggested putting some of the new tax money toward appointing a liaison to increase communication with businesses and advised entrepreneurs to think twice before coming to Blawnox.

“If $400 is going to keep you from opening a business, maybe you shouldn’t open it,” Esser said.

Rick Aten, owner of Rick’s Barber Shop, has been cutting hair in Blawnox for 21 years.

He was vehemently against the tax and said it should not apply to him primarily because he rents and does not own the building housing his business.

“I’m not paying it,” Aten said. “I’m not doing it. They have chased out so many businesses here.”

The retired Marine said Blawnox officials should focus on increasing parking instead of the budget.

“It’s a free-for-all when finding parking spaces,” Aten said. “It’s like they’re grabbing for money out of the air. It’s crazy. They’ll get somebody to pay that $400, but it ain’t going to be me.”

The Blue Rose custom frame parlor is a relatively new business established a little less than three years ago along Freeport Road. It is owned by residents Michael Ninehouser and run in partnership with his wife, Michelle Babkes.

Ninehouser questioned the need for the tax, with the borough already functioning well with real estate and earned income tax collection.

“It just seems like being in this area, there’s a lot of taxes,” he said. “It’s not like it’s going to make anyone too excited, I feel, because we’re in the Fox Chapel Area School District. … It’s such an abstract thing when you’re living in a neighborhood and you don’t know the ins and outs of how everything functions.

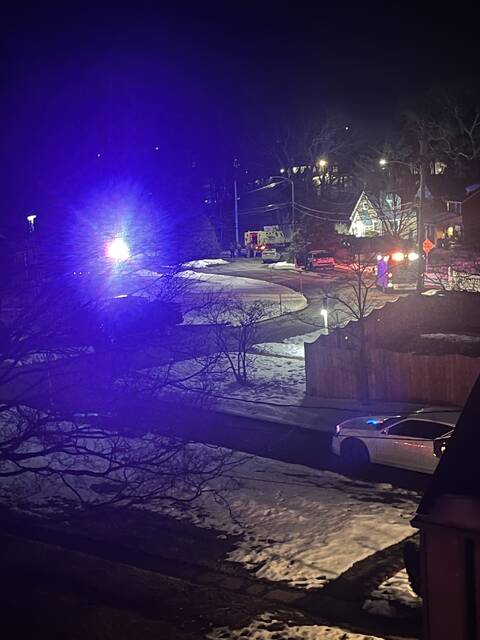

“All I know is that as a person who lives here and owns this shop, I see the ambulances working every day. I see the fire trucks working every day. The police are out and it’s like, ‘OK. Why do they need more money?’”

Ninehouser also acknowledged the rising cost of living with inflation, tariffs and other economic factors.

“This is a weird time to bring up a $400 thing for sure because the person we have in charge right now is making stuff harder for us economically,” he said. “Especially small business owners and people who don’t make a ton of money. It might just come off like, ‘It’s some other thing now,’ but it’s not Blawnox’s fault if they need the money and they need the help. It’s definitely not great timing.”