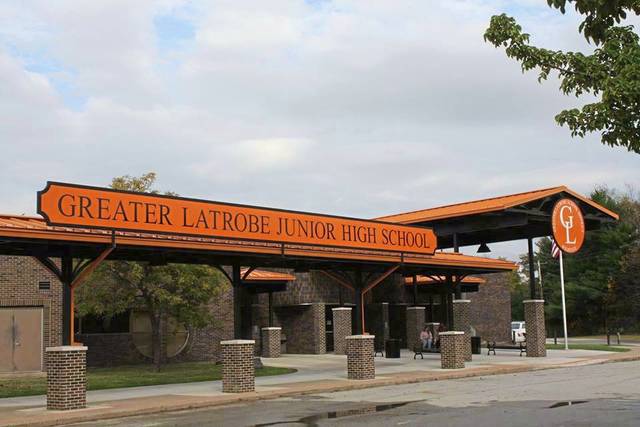

A Greater Latrobe Area School District policy that seeks reassessments of some newly purchased properties is the target of a lawsuit filed in Westmoreland County.

Unity residents Randolph and Vaune Gounder contend the school district improperly challenged the tax value of a home they bought in July for $585,000 as part of a system they claim puts new property owners at an unfair disadvantage.

“The defendant’s selective appeal program results in the plaintiffs and others similarly situated paying a disproportionate share of property taxes within the taxing district and violates the plaintiff’s rights to equal protection,” attorney James Conte wrote in the appeal.

The county assigned the Gounder’s property an assessment of $57,370. Assessments, which are used to calculate tax values, are based on 1972 cost of construction figures and, according to officials, currently represent 14.4% of a property’s fair market value.

The Gounders contend Latrobe school officials in appealing the assessment only claimed the purchase price was too low and did not include an alternate value for the appeals board to consider. The county’s assessment appeals board in September sided with the Gounders and declined to increase the assessment of their home.

The school district appealed that decision to Common Pleas Court. The case is still pending.

“The school district strives to be fair to all taxpayers, and we believe that this program meets that goal,” said Greater Latrobe’s solicitor Ned Nakles.

A district official, in an interview with the Tribune-Review in 2018, defended the policy in place since 2015 to seek reassessments of newly purchased properties valued at more than $684,000.

“It’s all about equity,” Latrobe business manager Dan Watson said at that time.

The Gounders want a county judge to rule the district’s reassessment program violates the U.S. and state constitutions, to dismiss the school districts appeal of the assessment board’s ruling and any other relief the court finds appropriate.

Other school districts have had similar targeted reassessment programs. Hempfield came under fire in 2017 after it was disclosed that it had appealed the assessments of a number of recently purchased properties that carried values believed to be $100,000 or more below a reported sales price.

Community opposition prompted the school board in 2018 to alter its program by raising the differential between assessments and sales prices to $250,000 before an appeal was filed.

Hempfield’s school board in January terminated the program.