Stock market advances and a cash infusion pushed Westmoreland County’s pension fund to a record level, with more than $675 million socked away to pay benefits for the county’s 1,400 retirees.

Proceeds from a $126 million bond purchase this summer hit the pension fund in August, a move county officials said could result in nearly $9 million in budget savings for taxpayers in the next two decades.

Meanwhile, the fund saw $29 million in gains in the past four months through investments, according to a report from Brad Hampton, vice president of Gallagher Fiduciary Advisors, the county’s pension fund manager.

In all, the pension fund saw earnings of 13.9% in the last year, according to Controller Jeff Balzer.

Projected savings from the bond deal are based on the fund sustaining annual average gains of about 7%.

Volatile financial markets resulted in a roller coaster-like performance for the pension account over the past year. The fund lost about $60 million after the onset of the coronavirus pandemic in March 2020 but ultimately rebounded and grew to about $500 million by the end of the year.

Gains continued in the first half of 2021.

The largest cash infusion came through the bond deal that Westmoreland commissioners said will serve as the county’s annual contribution to the retirement fund over the next 20 years and replace yearly payouts from the general fund budget.

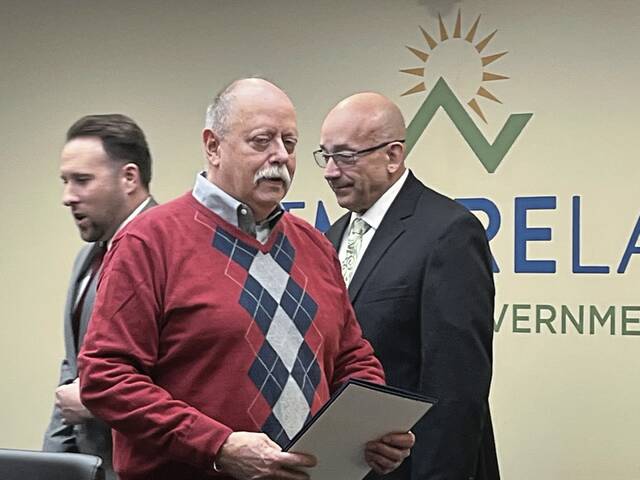

“This will allow us to get the money in the bank now,” said Commissioner Doug Chew.

That money ensures the pension account is about 100% funded to meet all future obligations, according to county leaders. Prior to the bond issue, the retirement account was listed at 82% funded.

“We’re actually at a really good position,” said Balzer. “I think our pension fund is incredibly strong.”

Debt payments for the pension fund bonds are planned through 2041.

Meghan McCandless, the county’s budget director, said annual debt payments for the bonds will increase over time. Payments will increase from nearly $3.3 million in 2022 and 2023 to more than $9.9 million from 2026 through 2040 before dropping to $6.7 million in the final year.

In all, the county is expected to pay $44 million in interest on the bonds in addition to repaying the $126 million in borrowed revenue.

Annual repayment of the bond debt replaces required yearly allocations to the pension fund from the county’s operating budget. Officials said that payment was estimated to be as much as $17 million in 2021. Instead, no money from the county budget will be directed into the pension fund this year.

The county transferred $12.7 million from its general fund to the pension account in 2020.

Commissioners touted the bond plan as a means to ensure financial certainty and improve budgeting over the next two decades without having to estimate yearly pension fund allocations.