Wells Fargo has launched a program to review claims from consumers who think they were harmed by the bank violating consumer protection laws.

The program is designed for people who believe they were affected by the bank but weren’t eligible for previous restitution programs.

Consumers could be entitled to relief from the bank through the redress program.

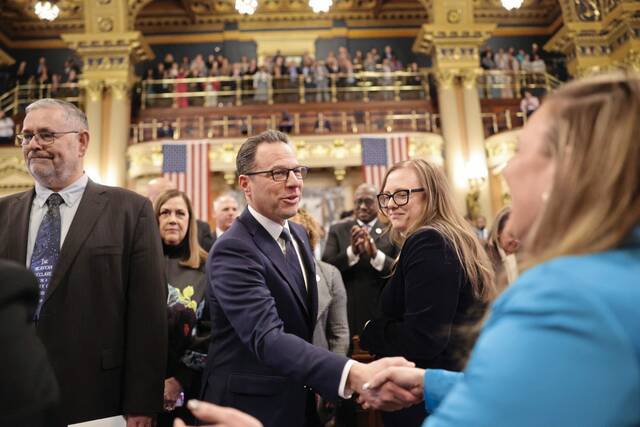

Pennsylvania Attorney General Josh Shapiro, whose office co-led an investigation of Wells Fargo and helped negotiate a related $575 million settlement late last year, announced the bank’s consumer redress program in a news release this week.

Shapiro said Wells Fargo’s violations related to online banking programs, auto insurance, mortgages and customer referrals the bank improperly made to providers of life insurance and renters insurance policies.

“The consumer redress review program is an important avenue for consumers seeking the relief they are entitled to for Wells Fargo’s improper conduct,” said Shapiro.

Shapiro is encouraging anyone with questions or concerns about the bank’s remediation programs to visit Wells Fargo’s website or call its escalation team at the following numbers:

• Unauthorized Accounts / Improper Retail Sales Practices: 1-844-931-2273

• Improper Renters and Life Insurance Referrals: 1-855-853-9638

• Force-Placed Automobile Collateral Protection Insurance (“CPI”): 1-888-228-9735

• Guaranteed Asset/Auto Protection (“GAP”) Refunds: 1-844-860-6962

• Mortgage Interest Rate Lock Extension Fees: 1-866-385-5008