Stocks edged lower on Wall Street in afternoon trading Thursday as investors remain cautiously optimistic about prospects for a new round of government aid as the economic recovery seemingly stalls.

Wall Street continued to digest solid corporate earnings and updates on a decline of new virus cases. The latest government report on jobless claims, though, reaffirmed that employment remains a weak spot in the economy as vaccine distribution ramps up in the hopes of eventually ending the pandemic and its impact.

The S&P 500 index fell 0.2% in another wobbly day of trading. The Dow Jones Industrial Average fell 123 points, or 0.4%, to 31.314 as of 2:19 p.m. Eastern after setting a new record high on Wednesday. The Nasdaq fell 0.1%.

Technology stocks were the only companies making gains after two relatively weak days. Most other sectors of the market were edging lower. The yield on 10-year Treasury note rose to 1.16% from 1.15% late Wednesday after being as high as 1.20% earlier this week.

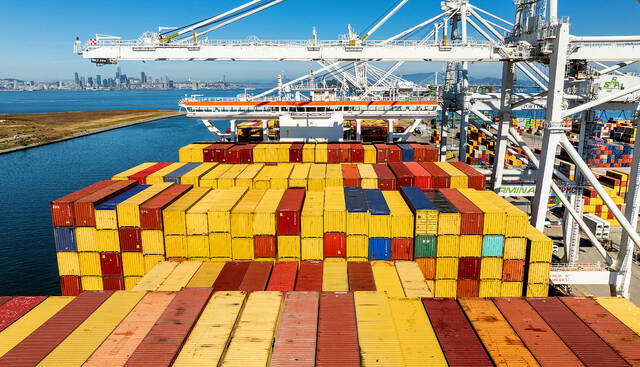

President Joe Biden held his first conversation with Chinese leader Xi Jinping. Although there wasn’t any indication of a major change in U.S. trade policy, businesses are hoping for a less combative approach to trade policy between the world’s two biggest economies than during the Trump administration. Technology companies were among some of the hardest hit companies by tough trade policies during the previous administration.

Many markets in Asia were closed for the Lunar New Year and other holidays. Markets in Europe were mostly higher.

Companies continued reporting mostly solid earnings, adding to a surprisingly good earnings season. Kraft Heinz climbed 5.1% and Zillow Group jumped 15.2% after beating Wall Street’s fourth-quarter profit forecasts.

The pandemic and business shutdowns are still hurting many companies and crimping their financial results. Molson Coors fell 10.2% for the biggest decline in the S&P 500 after its profits fell short of expectations because business shutdowns in Europe hurt sales.

Elsewhere in the market, shares of online dating service operator Bumble soared 71.4% on their first day of trading.

Wall Street is still looking for more government aid to help bolster the struggling economy as vaccine distribution progresses and the number of new virus cases continues falling. Democrats in Congress are working on a potential $1.9 trillion relief package that would include direct payments to people and more jobless aid as unemployment remains stubbornly high.

The number of Americans seeking unemployment benefits fell slightly last week to 793,000. The job market had shown tentative improvement last summer but slowed through the fall and in the past two months. Nearly 10 million jobs still remain lost to the pandemic.