A late slide pulled major indexes into the red on Wall Street Thursday, leaving the S&P 500 and the Dow Jones Industrial Average slightly below the record highs they set a day earlier. The benchmark S&P 500 gave up 0.3%. The Dow and the Nasdaq each fell 0.2%. Trading was relatively quiet with many investors having closed out their positions for the year. Cruise lines fell after the Centers for Disease Control and Prevention recommended that passengers avoid cruise travel, regardless of their covid-19 vaccination status. Crude oil prices rose slightly. The yield on the 10-year Treasury fell to 1.51%.

Most of Wall Street is on vacation or has closed their positions for 2021, which means trading is extremely light. Investors will likely not make any large moves until next week with the start of the New Year.

Investors got a couple bits of good news to close out the year. The number of Americans applying for unemployment benefits fell below 200,000, more evidence that the job market remains strong in the aftermath of last year’s coronavirus recession. Wall Street will get the December jobs report next week.

Meanwhile the Chicago Purchasing Manager Index, a gauge of manufacturing and economic activity, came in at 63.1 for December. That’s slightly better than the reading of 62.0 that economists were expecting, according to FactSet.

The major stock indexes are on pace to end December with solid gains, capping a banner year for the market. The S&P 500 is headed for a gain of more than 27% for 2021. That would be its best performance since 2019, another standout year for the market.

A wave of consumer demand fueled by the reopening of the economy pumped up corporate profits more than expected this year, which helped keep investors in a buying mood. The Federal Reserve also helped, by keeping interest rates low, which makes borrowing money more affordable for companies and consumers.

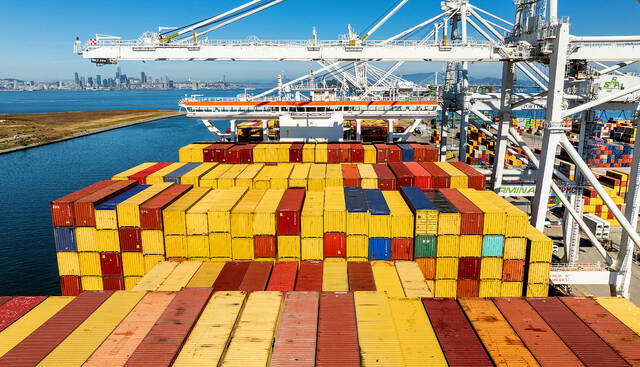

The market’s drop came in the face of economic challenges, including rising inflation, global supply chain disruptions and outbreaks of more contagious variants of the covid-19 virus.

Investor concerns about the omicron variant have eased in recent weeks after researchers said it appears to cause less severe symptoms and President Joe Biden avoided announcing travel or other restrictions that might weigh on economic activity. Still, markets are uncertain about the impact of omicron, which is spreading fast and quickly becoming the dominant variant.

Cruise lines fell Thursday after the Centers for Disease Control and Prevention recommended that passengers avoid cruise travel, regardless of their covid-19 vaccination status. Norwegian Cruise Line slid 2.2% and Carnival dropped 1.1%.

The yield on the 10-year Treasury note edged lower to 1.51% from 1.54% the day before.