WASHINGTON — The IRS said it will accept bank account information until noon Wednesday for people who want to receive stimulus payments by direct deposit.

After that, the IRS will send the money by check to the address on file, with those payments expected to arrive in late May and June, according to a statement from the agency Friday. Taxpayers can submit their information and check on the status of their payment at the IRS’ website.

“Time is running out for a chance to get these payments several weeks earlier through direct deposit,” IRS Commissioner Chuck Rettig said in the statement.

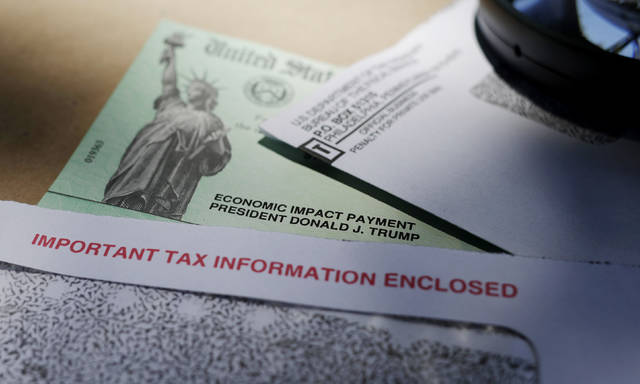

Approximately 130 million people have already received payments worth more than $200 billion, according to the IRS. The agency plans to send more than 150 million payments in total.

People who aren’t required to file tax returns — such as those who receive Social Security, disability and veterans benefits — will automatically receive their payments the same way they typically get their federal benefits.

The push to get payments out quickly comes as Congress is debating sending another round of direct payments to households as unemployment numbers skyrocket and many states remain fully or partially in lockdown in attempts to slow the spread of the coronavirus.

Democrats are proposing to send more direct payments, while President Donald Trump has said he prefers a payroll tax cut over stimulus checks.