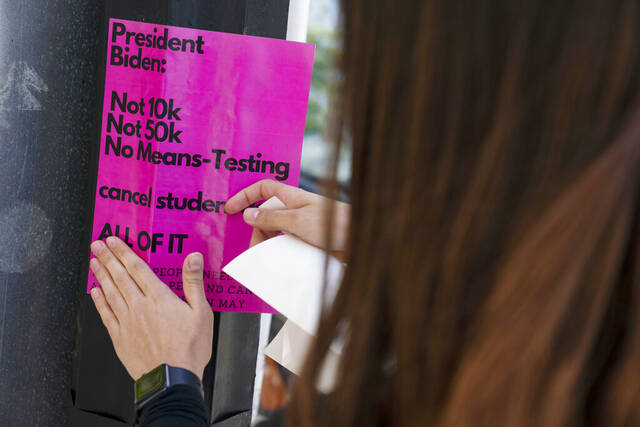

The Biden plan to cancel hundreds of billions of dollars in student loan payments has upset people on both sides of the political aisle, for reasons both political and personal.

Politically, the plan is an outrageous irony coming from President Joe Biden and “progressive” supporters like Sens. Elizabeth Warren and Bernie Sanders. Think about it: What could be more unprogressive than a policy that takes income from non-college grads to pay off through their taxes the debts of college grads? Those who chose not to go to school, perhaps because they couldn’t afford it, will help bail out those who did go to school.

Are Democrats the party of the working class or of educated elites?

This policy is regressive. It’s a massive wealth transfer from the uneducated class to the educated class.

It is also unnecessary. Aside from the fact that people are morally obligated to pay back money, consider that Biden and his handlers boast about the nation’s low unemployment rate. Well, if employment is good, then why bail out college grads? Are these tough times to get a job or not? I wrote recently about the problem of countless job openings going unfilled by young people opting not to join the workforce. Ask restaurant owners about the enormous challenge of finding waiters and waitresses.

Of course, some people are accepting those jobs as waiters and waitresses, some to pay off their student loans. Others accepting those jobs never went college, but they’ll now help to pay the loans of those who did go to college and aren’t accepting those jobs.

Then there is the personal component, which everyone can relate to, including those of us who amassed heaping loan debts and then struggled to conscientiously pay back money that wasn’t ours. Here’s my story:

I got a master’s degree from American University in Washington, D.C., in 1993. It cost a fortune. I got no financial aid. I really had no conception how onerous that debt would be. I had no debt from my undergraduate degree because my parents invested their life savings and because I worked 20-30 hours per week while at Pitt. It took me six years to get my undergrad degree, but I emerged debt-free. For my graduate work, I was not so fortunate.

Once my wife and I as newlyweds got our first bill for student loans, we were shocked. I think she cried. She also had gotten a master’s degree, and I had gone on to get a Ph.D. We couldn’t conceive how we were going to pay. We certainly weren’t looking to our mechanic and garbageman to help.

(For the record, the real scandal is the outrageously unjustifiable cost of higher education. Biden and the Democrats ought to be targeting their liberal buddies who run higher ed.)

How did we pay off the debt? I literally had to write a bestselling book — “God and Ronald Reagan,” published in 2004. Without that book, I don’t know how we would have managed.

Nonetheless, doing so was a financial and moral obligation. Millions of others have done the same. Some did so just before Biden stepped in and canceled debt obligations for their former classmates. One wonders how many young people going forward will now wait for their future debts to be canceled by Uncle Sam.

That’s my student loan story. What’s yours?

There are millions of them. And the Biden White House needs to hear them.