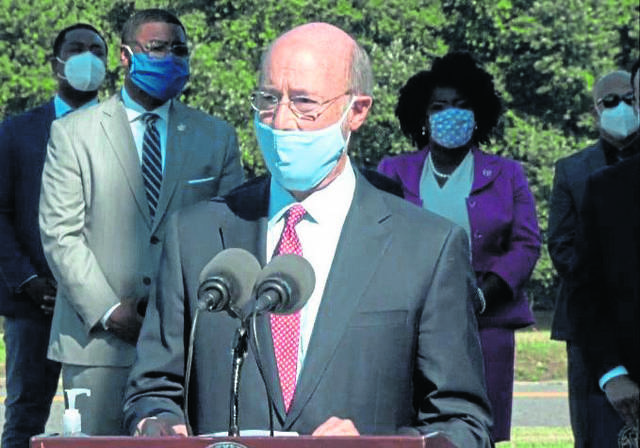

Without any input or authorization from elected Pennsylvania House and Senate members, Gov. Tom Wolf effectively shut down the Pennsylvania economy. His unilateral, one-size-fits-all lockdown decree has forced Pennsylvanians to suffer exponentially worse than citizens of other states that have adhered to Centers for Disease Control (CDC) protocols. As a result, the citizens of this commonwealth are confronted with the worst economic recession since the Great Depression and, sadly, there appears to be no end in sight.

The Pennsylvania General Assembly has attempted to restrain — by legislation and, when that failed, by litigation — some of the governor’s most intrusive policies, but we have been rebuffed by gubernatorial vetoes and a lack of Democratic support to override, and most recently, by the Democratic-controlled Pennsylvania Supreme Court.

In the midst of this economic crisis, Pennsylvanians question their ability to make their next housing or electric bill payment, or to fill up their car’s gas tanks. And yet Wolf is pushing forward with a scheme to impose over the next 10 years a $2.4 billion tax on electric generation, and considering a $12 billion tax on gasoline — again, without any legislative authority or input.

Wolf has submitted a proposed regulation to join a cartel of liberal Northeastern states, like New York and Massachusetts, called the Regional Greenhouse Gas Initiative (RGGI). Membership will cost Pennsylvania taxpayers and ratepayers $2.4 billion over 10 years. Wolf is also positioning Pennsylvania to join the Transportation and Climate Initiative (TCI), another group of liberal Northeastern states, that will cost Pennsylvania motorists $12 billion over 10 years or, at a minimum, 17 cents per gallon more than our current gas tax, which is already the second highest in the United States.

Revenues from both of these massive taxes are intended to fund windmills, solar panels and the buildout of electric vehicle infrastructure, and all of the costs will be borne by hard-working Pennsylvanians. It is also worth noting that both organized labor and the business community oppose both RGGI and TCI.

Both of these proposed taxes are in direct violation of the Pennsylvania Constitution, which provides the legislative branch with the exclusive power to tax. And, with respect to the TCI tax, the Constitution also mandates that all revenues from motor fuels taxes be used for road and bridge construction, not electric vehicles, which only the wealthiest of Pennsylvanians can currently afford.

It is within this context that the General Assembly is considering legislation — Senate Bill 950 and House Bill 2025 — that would preclude the governor from imposing the RGGI or TCI taxes without prior, express legislative authorization. I am proud to be a sponsor of SB 950 and a strong supporter or HB 2025, which passed the Pennsylvania House of Representatives with an impressive, bipartisan majority and will likely pass the Senate with similar bipartisan support. Unfortunately, Wolf has threatened to veto this legislation. In order to override his veto, House and Senate Democrats will have to choose between their constituents and organized labor or their governor.

I am deeply concerned that Wolf’s proposed RGGI and TCI taxes will be harmful to my constituents and the citizens of Pennsylvania. I will do everything in my power to stop the governor in his reckless disdain for hard-working, blue-collar families and communities, and urge my Senate (and House) Democratic colleagues from Western Pennsylvania to join me in this important battle. With their support, we can win this battle. Without it, we will all lose.

State Sen. Kim Ward, representing Pennsylvania’s 39th District, is majority chair of the Senate Transportation Committee.