No one likes uncertainty. For some, it carries with it a sense of doom and helplessness. Yet despite many people’s apparent aversion to uncertainty, some actively seek it out in many areas of their life.

Uncertainty is all around us. It has been making headlines in the news this year, as the on-again, off-again Trump tariffs take hold and influence the economy. Businesses typically abhor uncertainty since many decisions must be made over extended time horizons. When large capital investments must be made, long term forecasts are typically used to justify expenditures. Give that all crystal balls are cloudy at best when looking into the future, such uncertainty ensures that every business decision is tainted with risk, not knowing if what is being planned for will end up occurring. This means that markets also dislike uncertainty, typically experiencing volatility during such times.

Yet on a personal level, uncertainty is something that many of us seek, perhaps even enjoy.

The growth of sports gambling into a multi-billion dollar industry illustrates how some people are actively pursuing uncertainty in their lives. Having money on a game adds a measure of excitement to it, even if the outcome of the game is uncertain on its own accord. Unfortunately, this uncertainty seeking may also encourage gambling addiction, with the legalization and growth of online sports gambling facilitating such risk-seeking behavior.

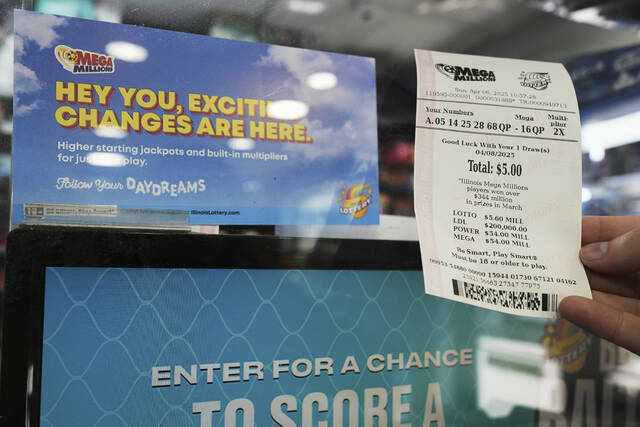

The same can be said about lotteries. The Power Ball and Mega Millions lotteries allow people to buy a dream for a few dollars. The likelihood of this dream coming to fruition is exceedingly small. Yet people continue to buy tickets, with the return on their purchase not in their favor.

Yet uncertainty is more than just gambling. Uncertainty also guides choices that people make in their everyday lives. When confronted with a fork in the road, each of us must choose one of two paths to take. Without full knowledge of the consequence of our choice, we hope to realize a favorable outcome. Sometimes we do, while we rarely know what the alternative path would have offered.

Whether it is about the type of automobile we purchase, the home that we buy or even the person who we choose as a life partner, every such choice is laden with uncertainty.

Yet at its core, uncertainty forces each of us to manage personal risks. We implicitly or explicitly balance the tradeoffs with choices, hoping to realize a favorable outcome. This is best illustrated with how we plan for retirement. At 25 years of age, the time horizon that lay before us seems unfathomably long. Short term sacrifices for a retirement that is decades into the future do not appeal to some young people. As a result, with each passing year, some will see their retirement portfolio stagnate while the light of retirement continues to grow brighter.

Others will view the long-term horizon as an opportunity to mitigate their personal risks, incrementally setting aside some of their current income to create retirement security for themselves. They make prudent investments, stashing away money in their employer-sponsored retirement accounts and individual IRAs, watching them grow with each passing year. Indeed, one of the most effective ways to mitigate risk is by leveraging time, with short term market swings smoothed out over long-term horizons.

In a world filled with uncertainty, there are no free lunches. Running from such risks is doomed to yield poor outcomes. Warren Buffet, the Oracle of Omaha and founder of Berkshire Hathaway, has enjoyed tremendous success by buying low and selling high. Nathan Rothchild, the 19th century British financier said “the time to buy investments is when there’s blood in the streets.” A corollary to his statement is to sell when there is overwhelming euphoria.

Hoping to win a lottery jackpot is not a wise retirement plan strategy. In contrast, buffering uncertainty and managing risk gives each of us the best opportunity to stay ahead of the pack, and perhaps even come out on top.

Though most of us say that we do not like uncertainty that can upend our lives, pleasant surprises are what we enjoy, perhaps even crave. Embrace uncertainty for what it offers, allowing each of us to use our time wisely.

Sheldon H. Jacobson is a professor in the Grainger College of Engineering at the University of Illinois Urbana-Champaign. A data scientist, he uses his expertise in risk-based analytics to address problems in public policy.